Finally biting the credit card bullet

Credit card points ➡️ international business class flights

My brother been jet setting around the world in business class (all via credit card points) whilst an underpaid healthcare worker in LA (underpaid as evidenced by the strikes this year, and in 2022)

My brother has been obsessed with credit card points for the last 5+ years.

To me, it was too complicated. I didn’t have time — I had more important things to focus on.

I didn’t see the value of all the headache and hassle.

That is until, last weekend…

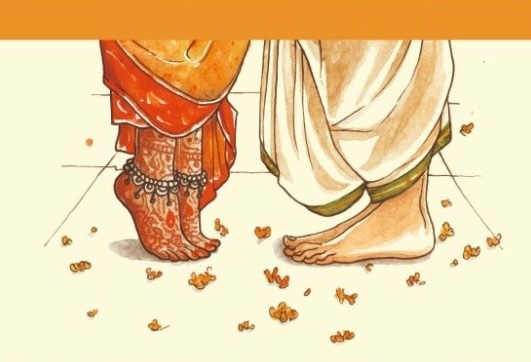

When we had to figure out travel to India for a friend’s wedding.

I have been incredibly excited for this trip —

It’s my first time in India and South Asia.

My friend and incredibly talented artist, Kaanchi Chopra, has been insisting that I come for years.

My friend Sam Enright wrote a great piece on South India with strong approval from our Chennai-native friend Chandhana.

But… these 22 hr+ journeys are not for the faint-hearted. I’ve always struggled sleeping on planes and fretted about the long flight, jet lag, and jumping right into wedding festivities

My brother suggested I hop in first class QSuites1 on Qatar Airways with all my credit card points.

I can’t understate how easy this was — it took <5 mins.

This one-way flight if paid with cash costs $6k (!!!)

Part 1: The 5 min process

First, on the Amex portal I transferred my Amex points to British Airways Avios points (which has a partnership with Qatar Airways).

There was a 30% bonus point conversion, so it turned into ~190k points

On the Avios.com site, I linked my British Airways + Qatar Airways accounts

I transferred over 170k points to Qatar Airways to purchase this flight.

That’s it! The value of my 140k points is ~$1400, but when used on a business class international flight, it’s value was $6k+.

This calculus made sense to me because traveling to India would be an entire day (of my life) so why not have a unique and special experience? (which was a reward for just spending money on my credit card).

Part 2: Getting the right credit cards

After this major win, I finally understood why my brother was obsessed with credit cards. This is how he was able to fund so many trips as an underpaid healthcare worker.

I had my three credit cards — Amex, Chase Sapphire, and DISCOVER.

“You need to cancel all of them”

Apparently, these were categorically bad cards, bad fees, and bad benefits (i.e., hard to redeem like $120 in uber eats credit).

He made an important distinction: keeper cards vs. churner cards.

The keeper cards are the ones you keep. The best two to have together are:

Bilt Rewards (use my code)

Up to 100k points from rent

Unique 2x, 3x+ point transfer multipliers (i.e., to airlines) — the benefits we’ve already discussed

Capital One Venture X (link)

Travel related rewards you’ll actually use (i.e., $300 travel credit)

The churner cards are the ones you churn for the onboarding bonus points (150k - 180k points) which is equivalent to a business class flight for minimal effort.

I haven’t done this yet, but I finally understand the rationale for why:

Credit card points ➡️ international business class flights

Let me know if you have any questions, and I’ll direct them to my brother.

These videos always rubbed me the wrong way

I did not expect to see my name here!

Great advice!!